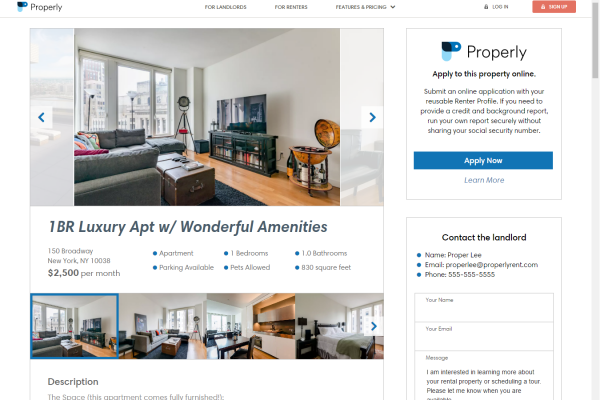

Renters should run their own credit reports and why it is beneficial for both the landlord and the renter

Traditionally, when a renter applies for a rental listing, he or she fills out an application and provides personal information such as a social security number (SSN) to the landlord. The landlord would then take that data to a credit reporting service to run the applicant’s report.

Now, think about how unsecure and unsafe that process is.

The renter is handing over his/her most personal and confidential information to a landlord who, in many cases, is a total stranger.

The landlord is responsible for safekeeping the renter’s private information. Improper handling and protection of this information can result in identity theft (the #1 crime in America affecting 15 million victims a year). In such an occurrence, the landlord could be held liable.

There is a better way! Renters should run their own credit reports and why it is beneficial for both the landlord and the renter:

Benefits for Landlords

- No need to collect SSNs

A SSN is required to pull a credit report. By having the renter run his own report, this is no longer necessary.

- No need to ensure appropriate safeguarding of SSN

Another benefit of not collecting a SSN is the landlord doesn’t have to worry about adhering to all of the varying and confusing state laws around protection of personal identifiable information (PII). The SSN will not appear on the credit report itself.

- No need to use a third party credit reporting service

For most landlords, running a credit report is usually the only thing in the application process that they can’t do themselves. They are forced to use a third party which is expensive and time-consuming.

- No need to argue over who pays

There is a cost to running credit reports and often landlords would collect a fee from applicants. Sometimes landlords absorb the cost themselves. By having renters run and pay for their own reports, there is no awkward discussions or negotiations on who should pay. We’ll explain how this actually saves money for the renter later on in this article.

- No need to send the credit reports to applicants

If a landlord rejects an application based on the renter’s credit score, the renter has the right to see the report. Many renters will ask for the report anyway. It is time consuming to deal with mailing, faxing, and/or emailing to satisfy these requests, especially if there are 10 or 20 applications per listing.

Benefits for Renters

- No need to share SSN with strangers

Most renters don’t personally know the landlords of rental listings they are applying to. Why trust strangers with your most private information?

- No need to worry about hits to your credit score

When a renter pulls his/her own report, it is considered a “soft” inquiry which does not impact the renter’s credit score. This is the same as checking your own credit.

However, if a renter lets the landlord run the report, this will often register as a “hard” inquiry which decreases the renter’s credit score. The most common example is when the landlord sends the renter’s application information to a third party screening company who then pulls the credit data. This is considered a hard inquiry because the renter had no direct involvement in the request.

Many renters apply to multiple rental listings with different landlords. Multiple hard inquiries in a short time frame can significantly damage a credit score.

- No need to worry about others making mistakes

Not all landlords know the correct procedure for pulling credit reports. There have been reports of landlords mistakenly requesting multiple inquiries on one renter. Again, this can severely decrease the renter’s credit score. Why take the risk?

- No need to pay for the same credit report multiple times

Since many renters apply to multiple rental listings with different landlords, they often have to pay for the credit report again and again on each application. This can be very costly.

Sure, a renter could apply to one place first and after the landlord runs the report, request a copy of it. However, while waiting for the report (which the renter has no control over), the other apartments may be scooped up already.

A renter who runs his own report can pay once and immediately include it in as many applications as needed.

- No need to be in the dark

By maintaining control of the credit report, a renter doesn’t have to take the risk of others making mistakes. In addition, credit data is not perfect and there may be inaccuracies on the report as well. If a renter is running his/her own report, the information can be reviewed right away. If there are mistakes on it, the renter can inform the credit bureaus immediately.

On the other hand, if the landlord runs and views the report first, the renter’s application may be rejected due to inaccurate or incomplete information, which is unfair to both parties. The renter can lose a dream apartment and the landlord can lose a great tenant.

What do you think?

We’ve presented our arguments for why it is beneficial to both landlords and renters to have the renter run his/her own credit report. Do you agree? How do you currently handle credit reporting?

P.S. There will be a ‘Part 2’ where we show you how we, at Properly, have created a solution that ensures general tenant screening processes, including credit reporting, are done securely, safely, and efficiently.

I would NEVER trust a tenants credit report. It may be old, made up, or not even the right kind.

It’s better to have the same type of report run, on every tenant. Treat them all the same. There is FICO, Exxperian plus, Transunion etc. FICO is the gold standard.

Hi Eric,

Totally agree with the concern that if the renter is handing over a paper report, it can be forged or outdated. For this to be safe and secure, it would need to be an electronic service where a renter runs his/her own report and when he/she picks a landlord to share it to, a fresh report is pulled straight from the Credit Bureau and delivered directly to the landlord without the renter touching it.

The many flavors of credit score is a good point. A landlord needs to compare apples to apples in order to ensure fairness so pick one and stick to it.

Thanks for the response.

George

P.S. I am a follower and fan of your blog. Great articles.

I agree. I wouldn’t allow them to run their own credit report. They forge the data and credit report (reasons listed above).

Hi Jordan,

Forgery is definitely a huge concern if the landlord isn’t receiving the report directly or if the renter is handing/forwarding the report to the landlord. Stay tuned for a part 2 follow-up to this article. We’ll present solutions that ensure forgery is never possible even when the renters are the ones running their own reports 🙂