In a prior article, Why Renters Should Run Their Own Credit Reports, we explained the benefits of renters running their own reports as part of the applicant screening process. The primary concerns we received as feedback from readers was the possibility of the reports being outdated or fraudulent. These concerns are certainly valid in cases where the renter is hand-delivering, emailing, or faxing a report to the landlord. The recipient landlord wouldn’t be able to confirm when the report was run and that the information has not been changed.

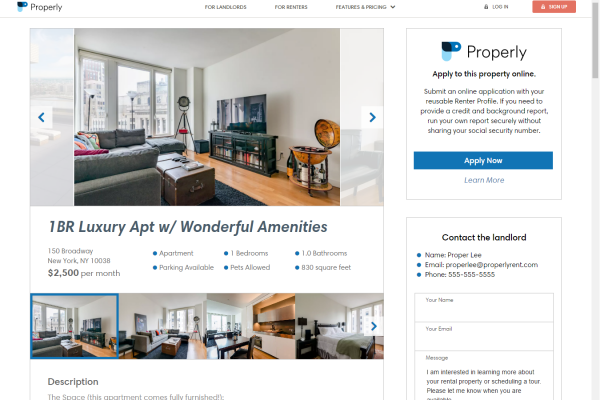

At Properly, we spent a great deal of effort developing an applicant screening process that is simple to use but more importantly, safe and secure. Here’s how we plan to handle this essential step of the application process.